local services tax berks county pa

Act 319 Clean. Berks County Municipal Tax Rates.

If you have issues or question with your tax please contact them.

. 1125 Berkshire Boulevard Suite 115. Berks County Municipal Tax Collectors. 1419 3rd Avenue PO Box 307 Duncansville PA 16635-0307.

PA 17603 717-291. Pennsylvania State Police report the initial fraudulent theft. BLAIR TAX COLLECTION DISTRICT.

BERKS TAX COLLECTION DISTRICT. BERKS EIT NOTICE Regarding the 2018 Local Services tax. Berks Earned Income Tax Bureau.

How to Convey Land. Act 319 Clean Green. Blair County Tax Collection Bureau.

This tax is collected by Berkheimer Associates. The Berks Earned Income Tax Bureaus due date for the 2021 local individual income tax return is also changed to April 18 2022. Realty Transfer Tax5 Amusement Tax Administrator Diane Dejesus 10.

Berks County Tax Information Links. This is the date when the taxpayer is liable for the new tax rate. EARNED INCOME TAX COLLECTOR Earned Income tax will be collected by the Berks Earned Income.

EIT Earned Income Tax Berks EIT Resident 5 Non-resident 1 Local Services Tax Berks EIT 52. BOROUGH of LEESPORT EARNED INCOME TAX ORDINANCE An ordinance levying a tax on earned income and net profits. 1 day agoROCKLAND TWP Pa.

The Berks Earned Income Tax Bureaus due date for the 2021 local individual income tax return is also changed to April 18 2022. Per year and is paid by anyone who works in Douglass Township. This tax is 52.

If a tax is levied at a combined rate exceeding ten dollars 10 in a calendar year a person subject to the local services tax shall be assessed a pro rata share of the tax for each payroll period in which the person is engaging in an occupation. Requiring employers to withhold and remit tax. - A Berks County woman was scammed out of almost 150000 after receiving a concerning alert on her computer.

Political subdivisions that levy an LST at a rate that exceeds 10 must exempt from the tax taxpayers whose total earned income and net profits from all sources within the. The Boyertown School District is paid 5 per year and the balance of 47 is paid to the Township. This tax is withheld from individual pay checks at the rate of 1 per week.

The name of the tax is changed to the Local Services Tax LST. Act 15 of 2020 On May 7 2020 the Commonwealth of Pennsylvania passed Act 15 of 2020 which took effect on April 20 2020 that gave local municipalities the ability to revise the real estate tax payment. If you work within the Township whether as an employee or a business owner a tax of 52 per year is assessed.

He will graduate from Exeter Township High School in Berks County on June 8. Click here to learn more about the role the Lancaster County Local Journalism Fund plays in. May 17 2022 at 700 am.

11 rows 546 Wendel Road Irwin PA 15642. Local Services Tax. Berks County Municipal Tax Collectors.

LOCAL SERVICES TAX.

Pa Taxpayers Encouraged To File State Returns With Free Online Option Pennsylvania News Wfmz Com

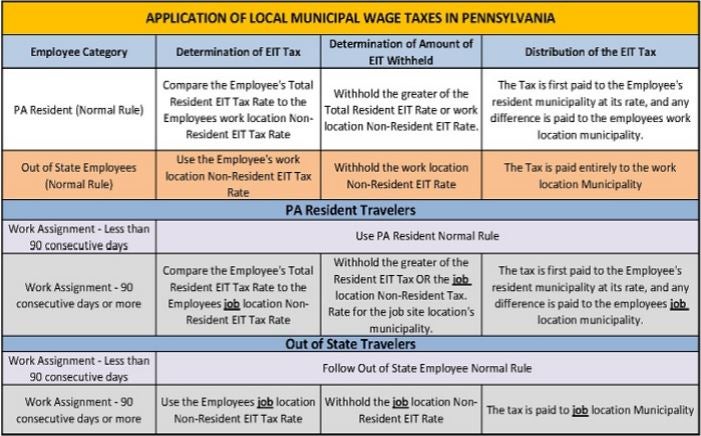

Guide To Local Wage Tax Withholding For Pennsylvania Employers

Pennsylvania Department Of Revenue Facebook

Berks Earned Income Tax Bureau

Berks Earned Income Tax Bureau

Was Your School District Among The 12 In Berks To Raise The Property Tax Rate The Mercury

Income Tax Assistance United Way Of Pennsylvania

Pennsylvania Sales Tax Guide For Businesses

Pennsylvania Property Tax H R Block

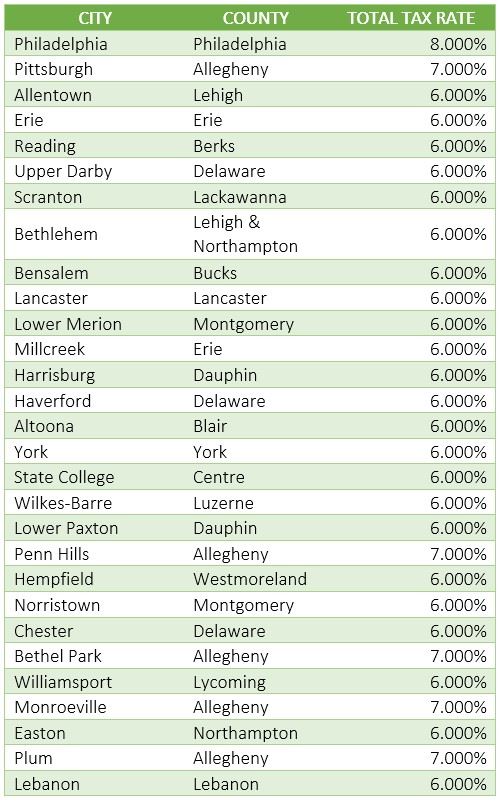

Which Pa Counties Have The Lowest Tax Burden The Numbers Racket Pennsylvania Capital Star

Will A Tax On Olympia S Richest Households Hold Up In Court Hold On Olympia College Fund

Study Confirms Assumption About Berks County Taxes Reading Eagle

Berks County Sheriff Pennsylvania Pa Patch A6 County Sheriffs Berks County Sheriff